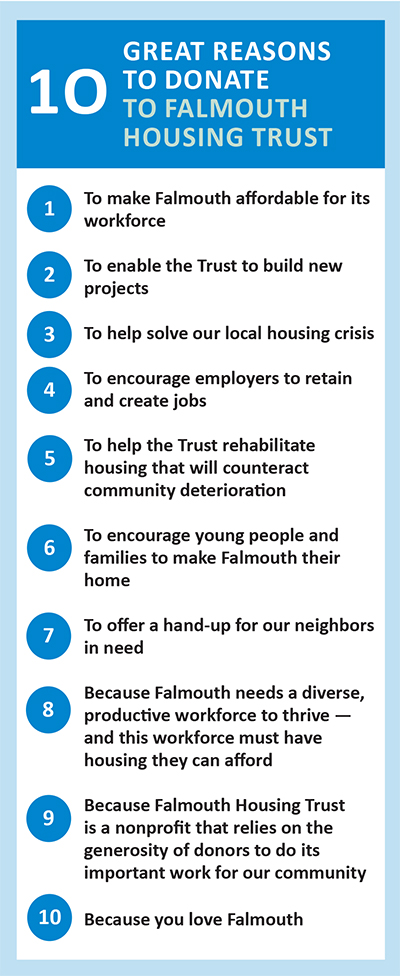

PLEASE CONSIDER DONATING TO THE TRUST TODAY!

We need your help to raise funds for…

New Projects Fund

General Fund

Ways to Give

Gifts to the Falmouth Housing Trust, Inc. help us to fund special projects, add programming, and serve more Falmouth constituents.

Falmouth Housing Trust, Inc. is a 501(C)3 nonprofit organization; all gifts are tax deductible.

Falmouth Housing Trust, Inc. accepts all donations. You may designate donations to where it’s most needed or as a restricted donation for a particular use or project. Please refer to out Current Initiatives.

If you would like to make a special gift, please contact Karen Bissonnette, Chief Developmnet Officer at the Falmouth Housing Trust, by phone 508-540-2370 or email: kb@falmouthhousingtrust.org .

Ways of Giving

Gifts of Cash

Check or Money Order

Please make checks payable to Falmouth Housing Trust, Inc.

Credit Card

Selling or Donating Property to FHT

If you donate property to FHT you are entitled to a charitable tax deduction for the full value of the property. FHT would collaborate with you to ensure the best possible use of the property. If you choose to sell your property to FHT for less than it’s worth, you would also be entitled to a charitable deduction on the difference between the sale amount and the property value. By helping FHT to acquire property, you could be part of the solution to Falmouth’s housing crisis.

An Unbuildable or Undersized Lot

If you own property that is undersized and too small for you to build upon, you could choose to sell or donate it to Falmouth Housing Trust. As a nonprofit that develops affordable housing, FHT can apply for a comprehensive permit that would allow FHT to create much-needed housing on lots that would not otherwise meet minimum size requirements.

Will or Bequest

Including the Falmouth Housing Trust, Inc. in your will or trust is the most frequent method of deferred giving. It requires simple language, such as: “I give, devise, and bequeath to Falmouth Housing Trust, Inc. all (or a percentage) of the residue of my estate to be used in such a manner as its Board of Directors determines for its general purposes.” This type of gift can be an important way to help Falmouth Housing Trust ensure that we will continue to serve the housing needs of Falmouth for years to come.

Gifts of Securities

You can make a bigger impact by giving appreciated securities including stocks, bonds or mutual funds to the Falmouth Housing Trust. Donating appreciated stock is better than giving cash because you can take a charitable deduction for the fair market value on the day of the gift, thereby avoiding capital gain taxes. Please contact Karen Bissonnette, Chief Development Officer, for more information and delivery instructions at 508-540-2370.

Gifts from your IRA

If you are 70 1/2 or older,you can make a Qualified Charitable Distribution (QCB) from your IRA to FHT. This tax benefit allows you to transfer up to $105,000 per person directly to a qualified charitable organization.At age 73, QCB also counts toward your Required Minimum Distribution for the year. At any age, you can designate FHT as the beneficiary of all or a percentage of your IRA and it will pass to us tax-free after your lifetime.

Gift Annuity

An annuity guarantees life income to the donor while providing a future benefit to the Falmouth Housing Trust, Inc.

Charitable Trusts

Charitable trusts provide a vehicle for a donor to establish a final gift for the Falmouth Housing Trust, Inc. while earning income from the established trust during the donor’s lifetime.

Life Insurance

By purchasing a life insurance policy and designating the Falmouth Housing Trust, Inc. as the irrevocable owner and beneficiary, a donor’s annual premium is considered a charitable contribution and the policy may create a gift much larger than a donor might otherwise be able to contribute. Another option is the donation of a paid life insurance policy to the Falmouth Housing Trust, Inc.

Matching Gifts

Many large corporations have established a program to match contributions made by their employees to charitable organizations. For more information, please check with your benefits or human resource manager or contact the Falmouth Housing Trust, Inc. to inquire.

Memorial or Honorary Gift

If you have a family member or friend whose life has been touched by Falmouth Housing Trust Inc. or its mission, we hope you’ll consider making a gift to us in honor of that person. Providing a gift establishes a living tribute that allows you to honor a loved one or yourself while supporting our continuing efforts and receiving personal financial benefits from your contribution. All donations are personally acknowledged (without mention of the monetary amount) and sent to the honored relative or friend or to the family of the deceased.

In-Kind Gifts

Many businesses and individuals make in-kind charitable gifts. These are gifts of services or items that have a monetary value, but no exchange of currency takes place. In-kind donations include building materials and supplies, labor, or professional services.

In-kind gifts are acknowledged and may be taken by the donor as a charitable tax-deduction; however the Falmouth Housing Trust, Inc. is unable to value such gifts per IRS regulations. Typically, a donor can calculate the value of such a gift in accordance with IRS tax regulations with the assistance of their certified public accountant.

Lori Andrews

Lori Andrews Maro Titus has a deep connection to the Falmouth Community that dates back to her childhood, shaping her passion for the area. Leveraging her successful career in healthcare administration, Maro has transitioned her expertise to Kinlin Grover Compass Real Estate. As a dedicated agent, she strives to understand each client’s unique needs, bringing a wealth of marketing knowledge and enthusiasm to the real estate practice. With a background in executive leadership encompassing strategic planning, government affairs, and business development, Maro’s professional journey is marked by a commitment to excellence.

Maro Titus has a deep connection to the Falmouth Community that dates back to her childhood, shaping her passion for the area. Leveraging her successful career in healthcare administration, Maro has transitioned her expertise to Kinlin Grover Compass Real Estate. As a dedicated agent, she strives to understand each client’s unique needs, bringing a wealth of marketing knowledge and enthusiasm to the real estate practice. With a background in executive leadership encompassing strategic planning, government affairs, and business development, Maro’s professional journey is marked by a commitment to excellence. Marie Bigelow retired in 2014 from Corporate Banking in Boston after 28 years, mostly with BankBoston, Citizens, and Santander Bank. Her banking experience is primarily as a Senior Credit professional with experience in diversified lending arenas including Non-Profit, Large Corporate, Middle Market, Asset Based, Leveraged Finance and Commercial Real Estate Lending. She brings strong financial analysis, real estate finance, and loan structuring experience to her new role at FHT.

Marie Bigelow retired in 2014 from Corporate Banking in Boston after 28 years, mostly with BankBoston, Citizens, and Santander Bank. Her banking experience is primarily as a Senior Credit professional with experience in diversified lending arenas including Non-Profit, Large Corporate, Middle Market, Asset Based, Leveraged Finance and Commercial Real Estate Lending. She brings strong financial analysis, real estate finance, and loan structuring experience to her new role at FHT. David Sutkowy has lived in Falmouth since 2020.

David Sutkowy has lived in Falmouth since 2020.  Director, Addie Drolette, is a Falmouth native and makes her home in East Falmouth. Most of Addie’s professional career has been spent serving the mortgage financing needs of the community of Falmouth. She is presently a Senior Residential Loan Officer with Martha’s Vineyard Bank.

Director, Addie Drolette, is a Falmouth native and makes her home in East Falmouth. Most of Addie’s professional career has been spent serving the mortgage financing needs of the community of Falmouth. She is presently a Senior Residential Loan Officer with Martha’s Vineyard Bank.  Savannah Fabbio lives in East Falmouth with her husband Jay and is a Mortgage Loan Officer for Shamrock Home Loans in Osterville. Prior to this she was an Assistant Vice President and Branch Manager for The Cooperative Bank of Cape Cod and Assistant Manager at Citizens Bank.

Savannah Fabbio lives in East Falmouth with her husband Jay and is a Mortgage Loan Officer for Shamrock Home Loans in Osterville. Prior to this she was an Assistant Vice President and Branch Manager for The Cooperative Bank of Cape Cod and Assistant Manager at Citizens Bank. Dave Garrison and his wife, Lori, moved to Falmouth in 2014 after full and interesting careers in Washington DC. Dave was raised in the Boston suburbs. He has been coming to the Cape every summer since 1944.

Dave Garrison and his wife, Lori, moved to Falmouth in 2014 after full and interesting careers in Washington DC. Dave was raised in the Boston suburbs. He has been coming to the Cape every summer since 1944.  After completing a 35 year career in marketing and communications, most recently as Senior Vice-President of Marketing for Dunkin’ U.S. – with previous marketing leadership roles at The Gillette Company and Ocean Spray Cranberries – Tom Manchester currently sits on the board and is an investor in a start-up business, The Mobile Locker Company and is also an instructor for Sports Marketing at Stonehill College.

After completing a 35 year career in marketing and communications, most recently as Senior Vice-President of Marketing for Dunkin’ U.S. – with previous marketing leadership roles at The Gillette Company and Ocean Spray Cranberries – Tom Manchester currently sits on the board and is an investor in a start-up business, The Mobile Locker Company and is also an instructor for Sports Marketing at Stonehill College.  Sudie Gifford comes to our board with an extremely varied background in arts, education, finance, public relations, and charity work.

Sudie Gifford comes to our board with an extremely varied background in arts, education, finance, public relations, and charity work. Susan Roman is the Owner of

Susan Roman is the Owner of  Troy Clarkson is an author and speaker with more than a quarter-century of experience in positions of leadership in government and public service. He has been actively involved in his beloved Falmouth since his teen years, when he wrote and published ‘The Cove Chronicle,’ a newspaper that he sold door-to-door for a quarter and that documented the lives of his friends and neighbors.

Troy Clarkson is an author and speaker with more than a quarter-century of experience in positions of leadership in government and public service. He has been actively involved in his beloved Falmouth since his teen years, when he wrote and published ‘The Cove Chronicle,’ a newspaper that he sold door-to-door for a quarter and that documented the lives of his friends and neighbors. Kevin McCarthy joined the board of directors of the Falmouth Housing Trust in 2012. Kevin’s entire career has been spent pursuing various “oceans” related endeavors, first as a professional diver, followed by various senior level management positions at a number of oceanographic manufacturing companies, including Klein Associates and Teledyne Benthos. He holds a B.S. from Northeastern University and an M.B.A. from Suffolk University. In 2000, he joined Hydroid LLC, a startup subsea robotics company that was founded to commercialize the REMUS autonomous underwater vehicle technologies developed at the Woods Hole Oceanographic Institution. In 2008, the company was acquired by the Norwegian company, Kongsberg Maritime. Kevin retired from his position of Vice President of Marketing in 2010 to devote more time to his passion for wildlife photography. Some of his work can be viewed at: www.McCarthyNatureImages.com.

Kevin McCarthy joined the board of directors of the Falmouth Housing Trust in 2012. Kevin’s entire career has been spent pursuing various “oceans” related endeavors, first as a professional diver, followed by various senior level management positions at a number of oceanographic manufacturing companies, including Klein Associates and Teledyne Benthos. He holds a B.S. from Northeastern University and an M.B.A. from Suffolk University. In 2000, he joined Hydroid LLC, a startup subsea robotics company that was founded to commercialize the REMUS autonomous underwater vehicle technologies developed at the Woods Hole Oceanographic Institution. In 2008, the company was acquired by the Norwegian company, Kongsberg Maritime. Kevin retired from his position of Vice President of Marketing in 2010 to devote more time to his passion for wildlife photography. Some of his work can be viewed at: www.McCarthyNatureImages.com. Information coming soon.

Information coming soon. Information coming soon.

Information coming soon. Joanne O’Sullivan is a real estate attorney who has been practicing law in Falmouth since 1995. She is a self described “wash-ashore” living on Cape Cod for close to 20 years. Joanne grew up in South Boston, and graduated from the University of Chicago and Boston College Law School. Attorney O’Sullivan has been a sole practitioner for the past six years. She is married and her children are enrolled in the Falmouth Public Schools. Ms. O’Sullivan joined the FHT Board of Directors in 2009 and became Vice President in 2011.

Joanne O’Sullivan is a real estate attorney who has been practicing law in Falmouth since 1995. She is a self described “wash-ashore” living on Cape Cod for close to 20 years. Joanne grew up in South Boston, and graduated from the University of Chicago and Boston College Law School. Attorney O’Sullivan has been a sole practitioner for the past six years. She is married and her children are enrolled in the Falmouth Public Schools. Ms. O’Sullivan joined the FHT Board of Directors in 2009 and became Vice President in 2011. Kenneth Buckland and his family; wife Nicolette and two boys, moved to Falmouth during Hurricane Gloria in 1985. They moved to town so that Ken could take the position as the Town Planner.

Kenneth Buckland and his family; wife Nicolette and two boys, moved to Falmouth during Hurricane Gloria in 1985. They moved to town so that Ken could take the position as the Town Planner. Joan Bates has lived in Falmouth with her husband, Robert, since 2002. Prior to that, the couple lived in Newton. Joan’s 25-year professional career was in special education and nonprofit management.

Joan Bates has lived in Falmouth with her husband, Robert, since 2002. Prior to that, the couple lived in Newton. Joan’s 25-year professional career was in special education and nonprofit management. Beth Ciarletta grew up in rural New Jersey then moved to Raleigh, NC for eighteen years where she met her husband Michael, co-founded a business, married and began their family. She relocated to Falmouth in 2012 with her husband to raise their children in a smaller community-based town, and to be closer to family. Her husband’s family lives in Norwood, MA and vacationed in Falmouth and on Cape Cod for many years.

Beth Ciarletta grew up in rural New Jersey then moved to Raleigh, NC for eighteen years where she met her husband Michael, co-founded a business, married and began their family. She relocated to Falmouth in 2012 with her husband to raise their children in a smaller community-based town, and to be closer to family. Her husband’s family lives in Norwood, MA and vacationed in Falmouth and on Cape Cod for many years. Carey Murphy lives in Waquoit with his wife of 31 years, Martha. Their three adult sons are all employed in the ski business, a sport that Carey loves to spend his winter months enjoying. They recently sold their retail business, Kensington’s at Mashpee Commons, after owning and operating it for 29 years.

Carey Murphy lives in Waquoit with his wife of 31 years, Martha. Their three adult sons are all employed in the ski business, a sport that Carey loves to spend his winter months enjoying. They recently sold their retail business, Kensington’s at Mashpee Commons, after owning and operating it for 29 years.